October offered some confusing feedback on the economy. On one hand, we had a strong equity rally which would be deemed positive. Yet, there are continued concerns of increased interest rates and its implications for economic growth. Below we look at trends in the commercial real estate market through CMBS monthly reporting to indicate a direction of the economy. So far, performance in the sector has been steady. While issuance in the CMBS market is lower than in recent experience, the market is still open for conduit and single asset/single borrower (SASB) transactions. We note below in Exhibits 1 and 2 continued improvement in the lodging sector. With the growth in SASB issuance in recent years, which have historically had best in class CRE underwriting, one would expect a nominal increase in credit issues. This will be a trend to watch going forward.

Exhibit 1: Percentage of Loans in Special Servicing by Property Type

Latest performance data in October remittances offers subtle changes. Loans in special servicing increased last month slightly. Loans backed by retail property and offices increased as well, yet loans backed by lodging properties declined slightly – both not swaying any view on the market or the economy.

As indicated in past reviews examining the aggregate of loans in forbearance and those 60 or more days delinquent gives a better proxy of potential problem loans than analyzing these metrics separately. We see a pronounced decline for loans backed by lodging properties. This indicates that the sector is making healthy strides in performance. Other sectors remained rather steady in comparison to last month with a slight uptick in retail.

Exhibit 2: CMBS Loans 60+ Days Delinquent or in Forbearance by Property Type

Further, loans added to special servicing in the last three months highlight a new trend of higher number of SASBs.

Exhibit 3: Loans by Deal Type Transferred to Special Servicing Since July 1, 2022

Has SASB performance changed?

Historically, SASBs are viewed as less volatile CRE investments backed by “trophy” properties or portfolios. Since 2021, SASB issuance outpaced conduit transaction issuance. This trend is likely to continue as properties transition from COVID-19 timeframe. Substantially higher fixed rate coupons recently create barriers to entry in the market for conduit loan origination.

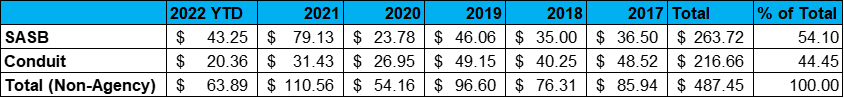

Exhibit 4: Issuance for Conduit and SASB Deals since 2017

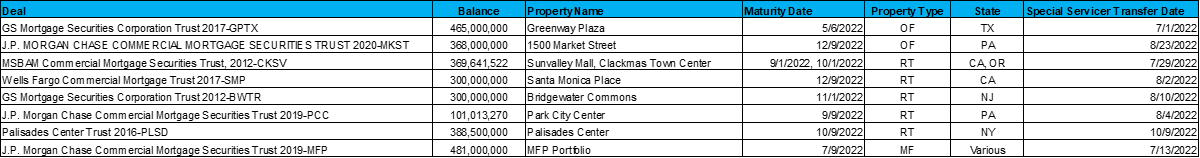

Despite stellar historical performance, the recent spate of transfers, especially in the retail and office sector, might indicate greater volatility ahead. Since July, seven SASBs have transferred to special servicing due to imminent or actual maturity default. Below in Exhibit 5, we highlight the trend in SASBs going into special servicing and their historic performance.

Exhibit 5: SASBs Transferred into Special Servicing Since July 1, 2022

Office

The office sector has been subject to endless articles regarding implications including recoveries from COVID-19, adjustments for working from home (WFH), and corporate behavior seen more in central business districts (i.e., larger cities) to move to “greener” facilities as leases mature. In general, performance has been better than expected. We highlight two SASBs below that have transferred to special servicing since July 2022. One is perceived as a property in a challenged metro rea and the other is also a struggling property within a performing submarket. Both are noteworthy but not indicative of a heightened negative trend.

- 2017-GPTX – The loan is secured by a business park known as Greenway Plaza in Houston, TX with about4.5 million square feet of office space. This loan transferred to special servicing on July 1, year for imminent maturity default. The property is 88%occupied, substantially higher than the submarket average (76%) and the metro average (73%), but overall, this is a struggling area for offices within Houston. The Richmond/Buffalo Speedway submarket has seen rents fall 3.7% over the last year, worst in the metro.

- 2020-MKST – This is a 1.7 million square foot office space in Philadelphia, PA with 69% occupancy. Unlike the loan above, this is a notably struggling property within an otherwise tight submarket. In fact, the four most central city submarkets within Philadelphia have the four highest occupancy rates, although rent growth is currently stagnant. Generally, we are seeing evidence of a flight to quality in dense urban areas. Per servicer commentary – ‘The most notable occupancy reductions over the past two years relate to few large leases that expired – Towers Watson (~244ksf – 5/20), Comcast (~90ksf – 8/21) and Berwind(~48ksf – 11/20)’. This loan transferred to special servicing on August 23.

Retail

While the longer run retail story remains “the haves and have nots”, an emerging story of redevelopment is presenting itself potentially relevant to the properties discussed below. Each property can be thought of part of an “ecosystem” of retail within a particular metro/submarket. As we have previously mentioned, we expect fewer retail properties to survive within each area (particularly for regional malls). While the declining values associated with this thinning are difficult situations for current owners and lenders, these declines are primed for redevelopment. Many of these properties are in good locations, often where developers see potential in a mixed use or “lifestyle” development. Even with growing construction and financing costs, many of these plans are being greenlit. This emerging model at least gives the potential for capital infusion into the struggling properties, helping areas where housing shortages and affordability are problematic.

- 2012-CKSV – Sunvalley Mall and Clackmas Town Center were both transferred to special servicing for imminent default on July27 per servicer comments. The former is in Concord, CA while the latter is in Happy Valley, Oregon. Both are retail properties with over 1.3 million sq. ft. and 93% occupancy, which is in line with their respective submarket occupancy numbers.

- 2017-SMP – This is a 500k square foot mall in Santa Monica, CA which was transferred to special servicing August 2 due to imminent default per servicer comments. Current occupancy is 59%. The borrower has submitted a proposal that contemplates a significant capital investment in exchange for an extension of the Dec 2022 maturity date to provide additional time to lease up and stabilize the property.

- 2012-BWTR – Bridgewater Commons is a 600,000 sq. ft. retail property in Bridgewater, NJ which is 90% occupied. The loan was transferred on August 10 due to an imminent default. Per servicer comments– ‘Over the years the property’s value has declined - a victim of obsolescence, store closures and, more recently, disruptions caused by COVID-19 and the overall state of the retail markets. Based on two recent Broker Opinions of Value received, the value of the asset is significantly below the loan balance and continues a more rapid decline as rates increase and the capital markets continue to deteriorate.’

- 2019-PCC – Park City Center is a 1.2 million sq. ft. retail property in Lancaster, PA which is 76% occupied. The loan was transferred to special servicing on August 4 due to imminent maturity default.

- 2016-PLSD – Palisades Center is a 1.9 million sq. ft. regional mall in West Nyack, NY which is 75% occupied. The loan was transferred to special servicing on September 27.

Multifamily

- 2019-MFP – This is a portfolio of multifamily properties in AL, AR, FL, IL, IN, LA, MS, OH, TN and TX. They have occupancies generally below or significantly below their submarket comparables. It was transferred on July 13 due to maturity default.

What has happened to SASBs in special servicing historically

Exhibit 6: SASB Loans Transferred into and Remaining in Special Servicing by Year

Exhibit 7: SASB Loans Transferred into and Remaining in Special Servicing by Vintage

Exhibits 6 and 7 above show the current outcomes for SASBs going into special servicing. Many of these deals cured, returned to master servicer or paid off, while some still remain in special servicing. Two deals ultimately took a loss. One deal is 2019-EMBSY, which is a hotel in midtown Manhattan, and the other is 2015-XLF2, which was a portfolio of 3 malls and 7 hotels. The former had a loss of less than $500,000 while the latter had a loss of approximately $17 million.

Exhibit 8: Outcomes for SABS transferred into Special Servicing by Year of Transfer

Exhibit 9: Number of SASBs currently in Special Servicing by Property Type

With higher interest rates, we expect refinancing conditions to become more challenging for otherwise currently performing properties. SASBs are now experiencing similar issues with higher base rates and expenses for required interest rate caps. However the changes in special servicing and delinquency/forbearance continue to be minor, but worthy of watching.

____________________________________________________________________________________________________________________________________________________________________

If you would like to learn more about how Moody’s Analytics can help you with your CMBS needs, please contact us.

Ankit Srivastava is an Assistant Director on the Moody’s Analytics CMBS desk within the Structured Solutions group. Prior to this, he completed his Master’s in Quantitative Finance at Rutgers Business School.

David Salz leads the Moody’s Analytics CMBS desk within the Structured Content Solutions group, providing timely and insightful data analytics to CMBS and CRE professionals. Prior to his current role, he managed the ABS desk and worked on various CLO related projects.

Thomas P LaSalvia, Ph.D. is a Senior Economist at Moody's Analytics, specializing in Commercial Real Estate. Thomas brings his pedagogical prowess to his extensive writing on the housing sector, while also curating CRE models, and supported credit risk analysis for a variety of clients.